The final Federal budget before the imminent Federal election has been released. Given the proximity between these two events, the budget wasn’t expected to be overly frugal and there are goodies. There are one off payments and tax rebates coming to try and keep everyone happy. Some warranted, others debateable.

It’s worth remembering we’ve had strong equity markets, record house price growth, record stimulus and the lowest interest rates the country has seen. There’s $250 billion sitting in household savings accounts and the unemployment rate is projected to fall below 4%. The idea that a large number of people in the middle class need a boost from government after such a boom is an interesting one.

Forecasts for net debt have improved, expected to now peak at $864 billion in 2025/26. Last year the forecast was sitting at $980 billion for 2024/25. No doubt the government was keen to avoid the one trillion mark in forecasts, along with the potential headlines that would accompany it. The budget deficit for 2022-23 is $78 billion.

The budget has an optimistic outlook on lower inflation and higher wages growth. Over the next few years, wages are expected to grow at their fastest pace in a decade over, from 2.75% to 3.25 per cent next year and 3.5 per cent by 2025. At the same time, despite all the additional spending, the budget suggests inflation will “peak well below that in most other advanced economies”. There’s no mention of what that peak is, but budget forecasts have the consumer price index at 4.25% before subsiding to 3% by June 2023 and 2.75% in 2024 and 2.25% in 2025.

Some continue to be worried about inflation, believing these figures will come under pressure. From veteran business journalist Robert Gottliebsen:

Treasury has told Frydenberg that we can control inflation partly because higher commodity prices are boosting the dollar and wage increases will be moderate. They say that while the increase in the hourly wage rate in the 12 months to June 30 is five per cent it will slump to 3.5 per cent in the next financial year. And that will happen because the CPI index, having risen by 4.25 per cent in 2021-22, will rise by only three per cent in 2022-23.

Those estimates look incredibly low given that the Treasurer is campaigning for higher wage rates and the core of the ALP campaign (and they are way ahead in the opinion polls) is for higher wages.

Onto the relevant points from the budget.

Income Tax/Individuals/Families

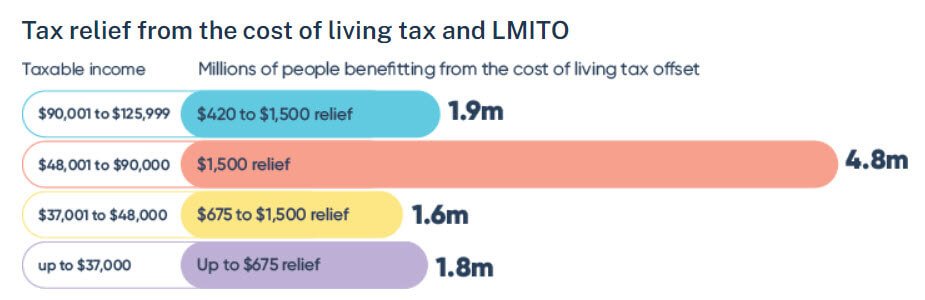

Low and Middle Income: The low and middle income tax offset has been retained and increased for the current financial year. Those earning up to $126,000 will see up to a $1500 offset when they file their tax return for this financial year.

However, workers should be aware the low and middle income tax offset has been omitted from the next financial year. If you’re filing your tax in July 2023, there will be no more relief unless it is extended at the next budget.

Employee Share Schemes: Access to employee share schemes has been expanded. Where employers make larger offers in connection unlisted companies, participants can invest up to:

$30,000 per participant per year, accruable for unexercised options for up to 5 years, plus 70 per cent of dividends and cash bonuses; or any amount, if it would allow them to immediately take advantage of a planned sale or listing of the company to sell their purchased interests at a profit.

Digitalising Trust Income Reporting: Trust and beneficiary income reporting and processing will be digitised, allowing all trust tax return filers the option to lodge income tax returns electronically, increasing pre-filling and automating ATO processes.

Paid Parental Leave: Single parents can now access the full 20 weeks of paid parental leave. Couples will get greater flexibility in deciding how paid leave is divided between them. Eligibility criteria will also be broadened. Under the current laws, mothers earning up to $151,350 can access paid leave, but anyone earning more is not entitled to it. The government is broadening the threshold so that any household with an income of up to $350,000 can use of the 20-week scheme.

Superannuation/Retirement

Superannuation Minimum Drawdown Reduction Extension: The 50% reduction of superannuation minimum drawdown requirements for account-based pensions has been extended until 30 June 2023. This has been done to ensure retirees have certainty and don’t have to draw down on assets and potentially sell at a loss. Thankfully this was the only superannuation change or non-change as it were. It’s not a bad one, but it does pose a question: if we’re going to change drawdown rates every time there’s a market upset or scary world event, why not just lower drawdown rates permanently?

Social Security

Cost of Living Payment: This is a $250 economic support payment to help eligible social security recipients with higher cost of living pressures. The payment will be made in April 2022 to eligible social security recipients such as pensioners, carers, veterans, job seekers, eligible self-funded retirees and concession card holders.

Pharmaceutical Benefits Scheme Lower Safety Net Threshold: From 1 July 2022, the Government is reducing the PBS Safety Net threshold, from $1,542.10 to $1,457.10 for general patients and from $326.40 to $244.80 for concessional patients.

Housing

Home Guarantee Scheme Increased

The Government will increase the number of guarantees under the Home Guarantee Scheme to 50,000 per year for 3 years from 2022-23 and then 35,000 a year ongoing for homebuyers to purchase a home with a lower deposit.

35,000 guarantees per year ongoing for the First Home Guarantee (formerly the First Home Loan Deposit Scheme) 5,000 places per year to 30 June 2025 for the Family Home Guarantee. 10,000 places per year to 30 June 2025 for a new Regional Home Guarantee that will support those who have not owned a home for 5 years to purchase a new home in a regional location with a minimum 5% deposit.

The merits of the government backing 2-5% deposits as house prices are at record highs, interest rates are at record lows, and inflation is increasing, are very questionable, but politicians are addicted to buy side housing “affordability” measures, and we note the opposition is proposing something similar.

Business & Training

Apprentices: A $2.8 billion investment to increase take up and completion rates of trade apprenticeships. New apprentices will access to a $5000 payment, while employers who take them on will be entitles to wage subsidies up to $15,000. $38 million over four years to support women starting trades on the national apprenticeship priority list.

National skills agreement: $3.7 billion for an additional 800,000 training places to help find employment for disadvantaged youth, Indigenous Australians, the mature aged and Australians with a disability.

Small Business Training: For every hundred dollars a small business spends on training their employees, they will receive a $120 tax deduction. Capped at $100,000.

Small Businesses Technology Investment Boost: For every $100 small businesses spend on digital technologies such as cloud computing, eInvoicing, cyber security and web design, they will get a $120 tax deduction. Capped at $100,000.

Additional Cost of Living Relief

Temporary Reduction in Fuel Excise: With fuel prices moving over $2 a litre, the government has reduced the fuel excise by half from March 30 for six months. The rate of excise applying to petrol and diesel is 44.2 cents per litre, which will cut it to 22.1 cents per litre. GST is also levied on excise, so consumers may see a little bit more than a 22.1 cent reduction.

As always, to ensure to you make the most of your money, your adviser can offer advice on how to best apply it to your circumstances.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.

With thanks to FYG Planners for this article